Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Federal Deposit Insurance Corporation

Release: National Rates and Rate Caps - Monthly Update

Units: Percent, Not Seasonally Adjusted

Frequency: Weekly, As of Monday

Notes:

The national rate is calculated by the FDIC as a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Data used to calculate the national rates are gathered by RateWatch.

Savings and interest checking account rates are based on the $2,500 product tier while money market and certificate of deposit are based on the $10,000 and $100,000 product tiers for non-jumbo and jumbo accounts, respectively. Account types and maturities are those most commonly offered by the banks and branches for which data is available- no fewer than 49,000 locations and as many as 81,000 locations reported. The deposit rates of credit unions are not included in the calculation.(http://www.fdic.gov/regulations/resources/rates/)

For more information, see the FDIC's Financial Institution Letter FIL-25-2009 issued on May 29, 2009 at http://www.fdic.gov/news/news/financial/2009/fil09025.html.

Suggested Citation:

Federal Deposit Insurance Corporation, National Rate on Non-Jumbo Deposits (less than $100,000): 3 Month CD (DISCONTINUED) [CD3NRNJ], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CD3NRNJ, .

Source: Federal Deposit Insurance Corporation

Release: National Rates and Rate Caps - Monthly Update

Units: Percent, Not Seasonally Adjusted

Frequency: Weekly, As of Monday

Notes:

The national rate is calculated by the FDIC as a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Data used to calculate the national rates are gathered by RateWatch.

Savings and interest checking account rates are based on the $2,500 product tier while money market and certificate of deposit are based on the $10,000 and $100,000 product tiers for non-jumbo and jumbo accounts, respectively. Account types and maturities are those most commonly offered by the banks and branches for which data is available- no fewer than 49,000 locations and as many as 81,000 locations reported. The deposit rates of credit unions are not included in the calculation.(http://www.fdic.gov/regulations/resources/rates/)

For more information, see the FDIC's Financial Institution Letter FIL-25-2009 issued on May 29, 2009 at http://www.fdic.gov/news/news/financial/2009/fil09025.html.

Suggested Citation:

Federal Deposit Insurance Corporation, National Rate on Non-Jumbo Deposits (less than $100,000): 60 Month CD (DISCONTINUED) [CD60NRNJ], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CD60NRNJ, .

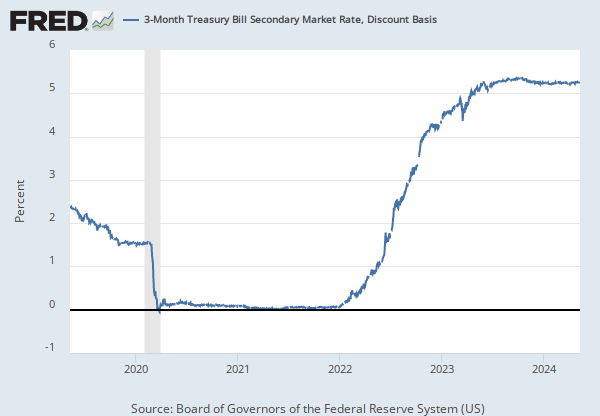

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of Business Days, Discount Basis

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), 3-Month Treasury Bill Secondary Market Rate, Discount Basis [TB3MS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TB3MS, .

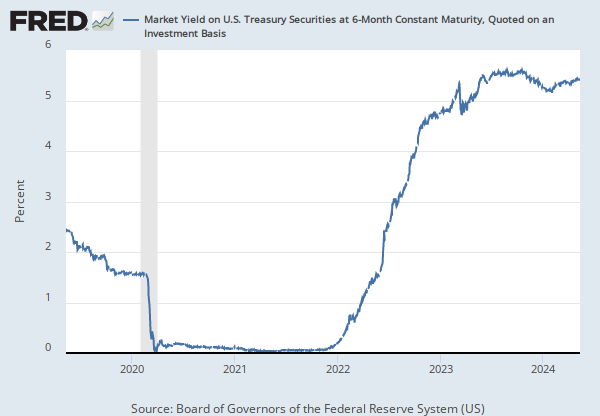

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis [DGS5], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS5, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

3-Month Treasury Bill Secondary Market Rate, Discount Basis

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.