Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

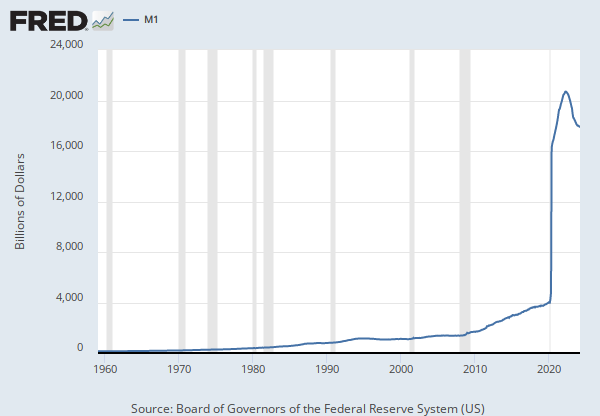

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

This weekly series is discontinued and will no longer be updated. The non-seasonally adjusted version of this weekly series is WM2NS, and the seasonally adjusted monthly series is M2SL.

Starting on February 23, 2021, the H.6 statistical release is now published at a monthly frequency and contains only monthly average data needed to construct the monetary aggregates. Weekly average, non-seasonally adjusted data will continue to be made available, while weekly average, seasonally adjusted data will no longer be provided. For further information about the changes to the H.6 statistical release, see the announcements provided by the source.

Before May 2020, M2 consists of M1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (3) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), M2 (DISCONTINUED) [M2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Chained 2017 Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A191RX

Real gross domestic product is the inflation adjusted value of the goods and services produced by labor and property located in the United States.For more information see the Guide to the National Income and Product Accounts of the United States (NIPA). For more information, please visit the Bureau of Economic Analysis.

Suggested Citation:

U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPC1, .

Source: Federal Reserve Bank of St. Louis

Release: St. Louis Monthly Reserves and Monetary Base

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

Updates of this series will be ceased on December 20, 2019. Interested users can access the not seasonally adjusted version of this series from the H.3 release, BOGMBASE.

For more details, see the FRED Announcement.

Suggested Citation:

Federal Reserve Bank of St. Louis, St. Louis Adjusted Monetary Base (DISCONTINUED) [AMBSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AMBSL, .

Release Tables

- Table 1.1.6. Real Gross Domestic Product, Chained Dollars: Quarterly

- Table 1.2.6. Real Gross Domestic Product by Major Type of Product, Chained Dollars: Quarterly

- Table 1.3.6. Real Gross Value Added by Sector, Chained Dollars: Quarterly

- Table 1.4.6. Relation of Real Gross Domestic Product, Real Gross Domestic Purchases, and Real Final Sales to Domestic Purchasers, Chained Dollars: Quarterly

- Table 1.5.6. Real Gross Domestic Product, Expanded Detail, Chained Dollars: Quarterly

- Table 1.7.6. Relation of Real Gross Domestic Product, Real Gross National Product, and Real Net National Product, Chained Dollars: Quarterly

- Table 1.8.6. Command-Basis Real Gross Domestic Product and Gross National Product, Chained Dollars: Quarterly

- Table 1.17.6. Real Gross Domestic Product, Real Gross Domestic Income, and Other Major NIPA Aggregates, Chained Dollars: Quarterly

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Real Gross Domestic Product

Annual, Not Seasonally Adjusted Quarterly, Not Seasonally Adjusted Index 2017=100, Quarterly, Not Seasonally Adjusted Percent Change from Preceding Period, Annual, Not Seasonally Adjusted Percent Change from Preceding Period, Quarterly, Seasonally Adjusted Annual Rate Percent Change from Quarter One Year Ago, Quarterly, Not Seasonally Adjusted Percent Change from Quarter One Year Ago, Quarterly, Seasonally AdjustedSt. Louis Adjusted Monetary Base (DISCONTINUED)

Biweekly, Not Seasonally Adjusted Biweekly, Not Seasonally Adjusted Biweekly, Seasonally Adjusted Biweekly, Seasonally Adjusted Monthly, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Monthly, Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.