Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

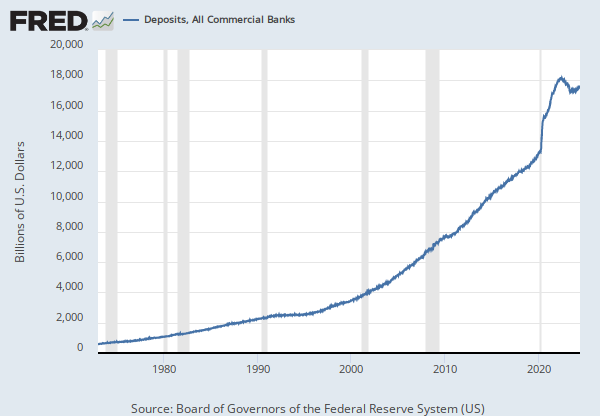

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Billions of U.S. Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Commercial and Industrial Loans, All Commercial Banks [BUSLOANS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BUSLOANS, .

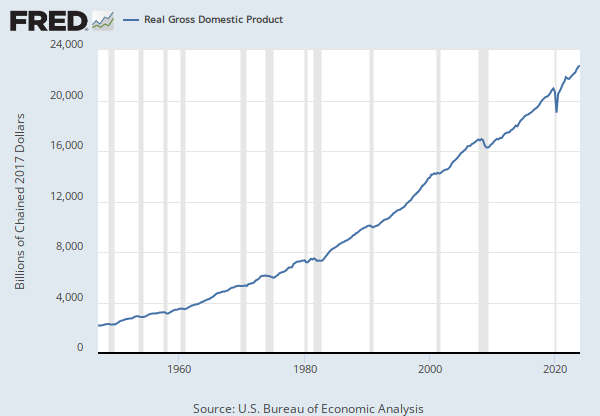

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Index 2017=100, Seasonally Adjusted

Frequency: Quarterly

Notes:

BEA Account Code: A191RD

The number of decimal places reported varies over time. A Guide to the National Income and Product Accounts of the United States (NIPA).

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross Domestic Product: Implicit Price Deflator [GDPDEF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPDEF, .

Source: Federal Reserve Bank of St. Louis

Release: Interest Rate Spreads

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Series is calculated as the spread between 10-Year Treasury Constant Maturity (BC_10YEARM) and 2-Year Treasury Constant Maturity (BC_2YEARM).

Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department.

Suggested Citation:

Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2YM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/T10Y2YM, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Percent, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

BEA Account Code: A011RE

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Shares of gross domestic product: Gross private domestic investment: Fixed investment: Residential [A011RE1Q156NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A011RE1Q156NBEA, .

Release Tables

- Table 1.1.9. Implicit Price Deflators for Gross Domestic Product: Quarterly

- Table 1.1.10. Percentage Shares of Gross Domestic Product: Quarterly

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Commercial and Industrial Loans, All Commercial Banks

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted Weekly, Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted Percent Change at Annual Rate, Annual, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Quarterly, Seasonally AdjustedGross Domestic Product: Implicit Price Deflator

Percent Change from Preceding Period, Annual, Not Seasonally Adjusted Percent Change from Preceding Period, Quarterly, Seasonally Adjusted Annual Rate10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Daily, Not Seasonally AdjustedShares of gross domestic product: Gross private domestic investment: Fixed investment: Residential

Annual, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.