Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

Before May 2020, M2 consists of M1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (3) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2SL, .

Source: U.S. Census Bureau

Release: National Population Estimates

Units: Thousands, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The intercensal estimates for 1990-2000 for the United States population are produced by converting the 1990-2000 postcensal estimates prepared previously for the U. S. to account for differences between the postcensal estimates in 2000 and census counts (error of closure). The postcensal estimates for 1990 to 2000 were produced by updating the resident population enumerated in the 1990 census by estimates of the components of population change between April 1, 1990 and April 1, 2000-- births to U.S. resident women, deaths to U.S. residents, net international migration (incl legal & residual foreign born), and net movement of the U.S. armed forces and civilian citizens to the United States. Intercensal population estimates for 1990 to 2000 are derived from the postcensal estimates by distributing the error of closure over the decade by month. The method used for the 1990s for distributing the error of closure is the same that was used for the 1980s. This method produces an intercensal estimate as a function of time and the postcensal estimates,using the following formula: the population at time t is equal to the postcensal estimate at time t multiplied by a function. The function is the April 1, 2000 census count divided by the April 1, 2000 postcensal estimate raised to the power of t divided by 3653.

Suggested Citation:

U.S. Census Bureau, Total Population: All Ages including Armed Forces Overseas [POP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/POP, .

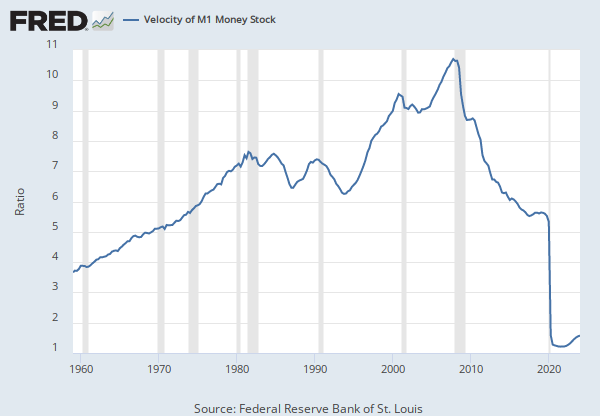

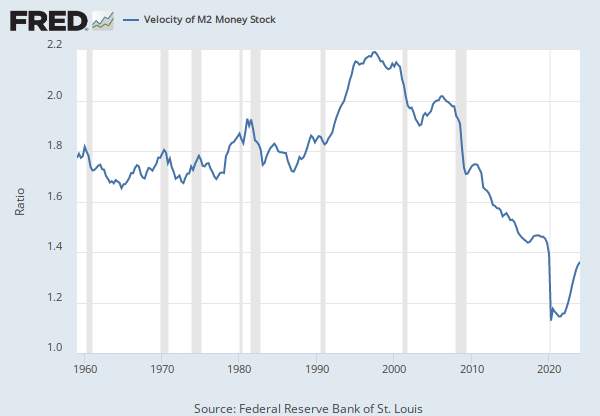

Source: Federal Reserve Bank of St. Louis

Release: Money Velocity

Units: Ratio, Seasonally Adjusted

Frequency: Quarterly

Notes:

Calculated as the ratio of quarterly nominal GDP to the quarterly average of M2 money stock.

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest. Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler's checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par on demand: notes and coins in circulation, traveler's checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds. The velocity of MZM helps determine how often financial assets are switching hands within the economy.

Suggested Citation:

Federal Reserve Bank of St. Louis, Velocity of M2 Money Stock [M2V], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2V, .

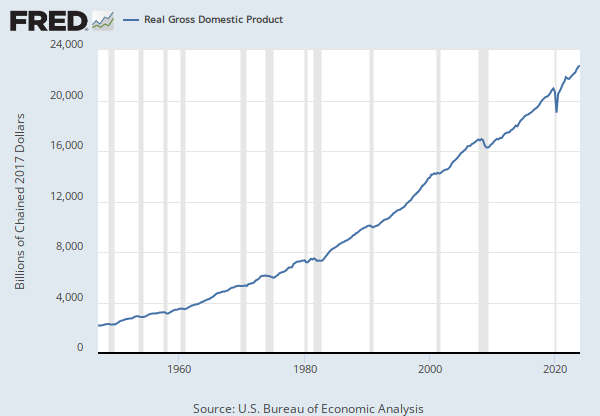

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A191RC

Gross domestic product (GDP), the featured measure of U.S. output, is the market value of the goods and services produced by labor and property located in the United States.For more information, see the Guide to the National Income and Product Accounts of the United States (NIPA) and the Bureau of Economic Analysis.

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP, .

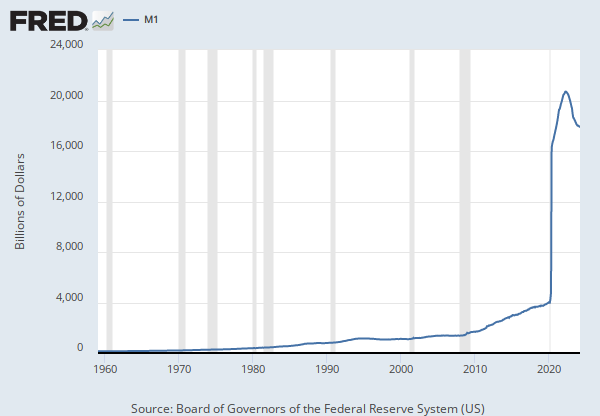

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

The currency component of M1, sometimes called "money stock currency," is defined as currency in circulation outside the U.S. Treasury, Federal Reserve Banks, and vaults of depository institutions. Data on total currency in circulation are obtained weekly from balance sheets of the Federal Reserve Banks and from the U.S. Treasury. Weekly currency in circulation data are published each week on the Federal Reserve Board's H.4.1 statistical release "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks." Vault cash is reported on the FR 2900 and subtracted from total currency in circulation. For institutions that do not file the FR 2900, vault cash is estimated using data reported on the Call Reports.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Currency Component of M1 [CURRSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CURRSL, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), All Sectors; Total Debt Securities; Liability, Level [ASTDSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ASTDSL, .

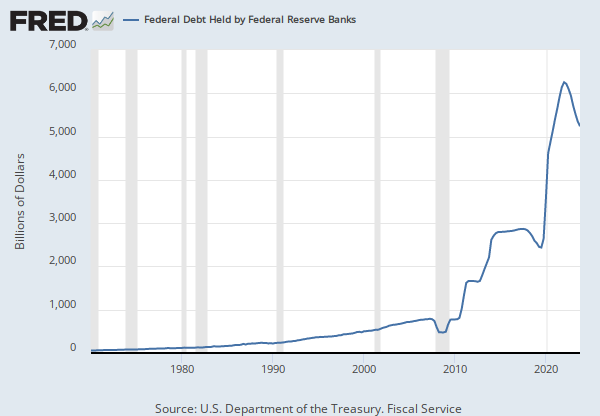

Source: U.S. Department of the Treasury. Fiscal Service

Release: Treasury Bulletin

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Suggested Citation:

U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEBTN, .

Release Tables

- Table 1.1.5. Gross Domestic Product: Quarterly

- Table 1.2.5. Gross Domestic Product by Major Type of Product: Quarterly

- Table 1.3.5. Gross Value Added by Sector: Quarterly

- Table 1.4.5. Relation of Gross Domestic Product, Gross Domestic Purchases, and Final Sales to Domestic Purchasers: Quarterly

- Table 1.5.5. Gross Domestic Product, Expanded Detail: Quarterly

- Table 1.7.5. Relation of Gross Domestic Product, Gross National Product, Net National Product, National Income, and Personal Income: Quarterly

- Table 1.17.5. Gross Domestic Product, Gross Domestic Income, and Other Major NIPA Aggregates: Quarterly

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

M2

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedGross Domestic Product

Annual, Not Seasonally Adjusted Annual, Not Seasonally Adjusted Index 2017=100, Quarterly, Not Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted Percent Change from Preceding Period, Annual, Not Seasonally Adjusted Percent Change from Preceding Period, Quarterly, Seasonally Adjusted Annual RateCurrency Component of M1

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedAll Sectors; Total Debt Securities; Liability, Level

Annual, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.