Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A091RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Federal government current expenditures: Interest payments [A091RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A091RC1Q027SBEA, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: W006RC

Visit the BEA for more information about this series.

Suggested Citation:

U.S. Bureau of Economic Analysis, Federal government current tax receipts [W006RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/W006RC1Q027SBEA, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A824RC

A Guide to the National Income and Product Accounts of the United States (NIPA) - (http://www.bea.gov/national/pdf/nipaguid.pdf)

Suggested Citation:

U.S. Bureau of Economic Analysis, Federal Government: National Defense Consumption Expenditures and Gross Investment [FDEFX], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FDEFX, .

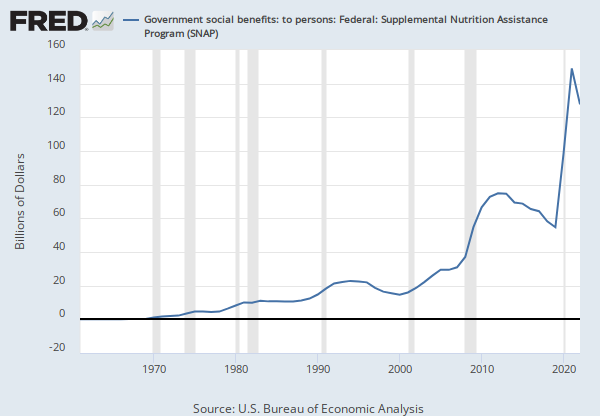

Source: U.S. Bureau of Economic Analysis

Release: Personal Income and Outlays

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Monthly

Notes:

BEA Account Code: W823RC

Social security benefits include old-age, survivors, and disability insurance benefits that are distributed from the federal old-age and survivors insurance trust fund and the disability insurance trust fund.

A Guide to the National Income and Product Accounts of the United States (NIPA) - (http://www.bea.gov/national/pdf/nipaguid.pdf)

Suggested Citation:

U.S. Bureau of Economic Analysis, Personal current transfer receipts: Government social benefits to persons: Social security [W823RC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/W823RC1, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: B087RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Federal government current transfer payments: Government social benefits: to persons [B087RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/B087RC1Q027SBEA, .

Source: Organization for Economic Co-operation and Development

Release: Main Economic Indicators

Units: Index 2015=100, Not Seasonally Adjusted

Frequency: Monthly

Notes:

OECD Data Filters:

REF_AREA: USA

MEASURE: CPI

UNIT_MEASURE: IX

METHODOLOGY: N

EXPENDITURE: _TXCP01_NRG

ADJUSTMENT: N

TRANSFORMATION: _Z

FREQ: M

All OECD data should be cited as follows: OECD (year), (dataset name), (data source) DOI or https://data-explorer.oecd.org/. (accessed on (date)).

Suggested Citation:

Organization for Economic Co-operation and Development, Consumer Price Indices (CPIs, HICPs), COICOP 1999: Consumer Price Index: All Items Non-Food Non-Energy for United States [USACPICORMINMEI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USACPICORMINMEI, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of daily figures.

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve as it uses the Interest on Reserve Balances rate to steer the federal funds rate toward the target range.(2)

The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target range. The Fed's primary tool for influencing the federal funds rate is the interest the Fed pays on the funds that banks hold as reserve balances at their Federal Reserve Bank, which is the Interest on Reserves Balances (IORB) rate. Because banks are unlikely to lend funds in the federal funds market for less than they get paid in their reserve balance account at the Federal Reserve, the Interest on Reserve Balances (IORB) is an effective tool for guiding the federal funds rate. (3) Whether the Federal Reserve raises or lowers the target range for the federal funds rate depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may temper economic activity by raising the target range for federal funds rate, and increasing the IORB rate to steer the federal funds rate into the target range. In the opposing scenario, the FOMC may spur greater economic activity by lowering the target range for federal funds rate, and decreasing the IORB rate to steer the federal funds rate into the target range. (3) Therefore, the FOMC must observe the current state of the economy to determine the best course of monetary policy that will maximize economic growth while adhering to the dual mandate set forth by Congress. In making its monetary policy decisions, the FOMC considers a wealth of economic data, such as: trends in prices and wages, employment, consumer spending and income, business investments, and foreign exchange markets.

The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.(2)

References

(1) Federal Reserve Bank of New York. "Federal funds." Fedpoints, August 2007.

(2) Monetary Policy, Board of Governors of the Federal Reserve System.

(3) The Fed Explained, Board of Governors of the Federal Reserve System

For further information, see The Fed's New Monetary Policy Tools, Page One Economics, Federal Reserve Bank of St. Louis.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, .

Release Tables

- Table 1.1.5. Gross Domestic Product: Quarterly

- Table 1.5.5. Gross Domestic Product, Expanded Detail: Quarterly

- Table 3.2. Federal Government Current Receipts and Expenditures: Quarterly

- Table 3.9.5. Government Consumption Expenditures and Gross Investment: Quarterly

- Table 3.11.5. National Defense Consumption Expenditures and Gross Investment by Type: Quarterly

- Table 3.15.5. Government Consumption Expenditures and Gross Investment by Function: Quarterly

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Federal government current expenditures: Interest payments

Millions of Dollars, Quarterly, Not Seasonally AdjustedFederal government current tax receipts

Annual, Not Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally AdjustedPersonal current transfer receipts: Government social benefits to persons: Social security

Annual, Not Seasonally Adjusted Quarterly, Seasonally Adjusted Annual RateFederal government current transfer payments: Government social benefits: to persons

Annual, Not Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally AdjustedConsumer Price Indices (CPIs, HICPs), COICOP 1999: Consumer Price Index: All Items Non-Food Non-Energy for United States

Growth rate same period previous year, Annual, Not Seasonally Adjusted Growth rate same period previous year, Monthly, Not Seasonally Adjusted Growth rate same period previous year, Quarterly, Not Seasonally Adjusted Annual, Not Seasonally Adjusted Monthly, Seasonally Adjusted Quarterly, Not Seasonally Adjusted Quarterly, Seasonally AdjustedFederal Funds Effective Rate

Annual, Not Seasonally Adjusted Biweekly, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.