Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: DNPERC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Personal consumption expenditures: Services: Gross output of nonprofit institutions [DNPERC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DNPERC1A027NBEA, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: A191RC

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross Domestic Product [GDPA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPA, .

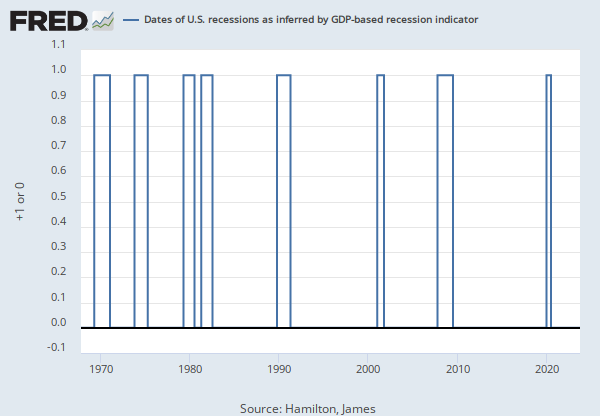

Source: Hamilton, James

Release: GDP-Based Recession Indicator Index

Units: Percentage Points, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

This index measures the probability that the U.S. economy was in a recession during the indicated quarter. It is based on a mathematical description of the way that recessions differ from expansions. The index corresponds to the probability (measured in percent) that the underlying true economic regime is one of recession based on the available data. Whereas the NBER business cycle dates are based on a subjective assessment of a variety of indicators that may not be released until several years after the event, this index is entirely mechanical, is based solely on currently available GDP data and is reported every quarter. Due to the possibility of data revisions and the challenges in accurately identifying the business cycle phase, the index is calculated for the quarter just preceding the most recently available GDP numbers. Once the index is calculated for that quarter, it is never subsequently revised. The value at every date was inferred using only data that were available one quarter after that date and as those data were reported at the time.

If the value of the index rises above 67% that is a historically reliable indicator that the economy has entered a recession. Once this threshold has been passed, if it falls below 33% that is a reliable indicator that the recession is over.

For more information about this series visit http://econbrowser.com/recession-index.

Suggested Citation:

Hamilton, James, GDP-Based Recession Indicator Index [JHGDPBRINDX], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/JHGDPBRINDX, .

Release Tables

- Table 1.1.5. Gross Domestic Product: Annual

- Table 1.2.5. Gross Domestic Product by Major Type of Product: Annual

- Table 1.3.5. Gross Value Added by Sector: Annual

- Table 1.4.5. Relation of Gross Domestic Product, Gross Domestic Purchases, and Final Sales to Domestic Purchasers: Annual

- Table 1.5.5. Gross Domestic Product, Expanded Detail: Annual

- Table 1.7.5. Relation of Gross Domestic Product, Gross National Product, Net National Product, National Income, and Personal Income: Annual

- Table 1.17.5. Gross Domestic Product, Gross Domestic Income, and Other Major NIPA Aggregates: Annual

- Table 2.3.5. Personal Consumption Expenditures by Major Type of Product: Annual

- Table 2.4.5. Personal Consumption Expenditures by Type of Product: Annual

- Table 2.5.5. Personal Consumption Expenditures by Function: Annual

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Personal consumption expenditures: Services: Gross output of nonprofit institutions

Quarterly, Seasonally Adjusted Annual RateGross Domestic Product

Annual, Not Seasonally Adjusted Quarterly, Seasonally Adjusted Annual Rate Index 2017=100, Quarterly, Not Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted Percent Change from Preceding Period, Annual, Not Seasonally Adjusted Percent Change from Preceding Period, Quarterly, Seasonally Adjusted Annual RateRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.