Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Federal Reserve Bank of Philadelphia

Release: State Leading Indexes

Units: Percent, Seasonally Adjusted

Frequency: Monthly

Notes:

The leading index for each state predicts the six-month growth rate of the state's coincident index. In addition to the coincident index, the models include other variables that lead the economy: state-level housing permits (1 to 4 units), state initial unemployment insurance claims, delivery times from the Institute for Supply Management (ISM) manufacturing survey, and the interest rate spread between the 10-year Treasury bond and the 3-month Treasury bill.

Suggested Citation:

Federal Reserve Bank of Philadelphia, Leading Index for the United States [USSLIND], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USSLIND, .

Source: Chauvet, Marcelle

Source: Piger, Jeremy Max

Release: U.S. Recession Probabilities

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., "An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching," International Economic Review, 1998, 39, 969-996.

For additional details, including an analysis of the performance of this model for dating business cycles in real time, see:

Chauvet, M. and J. Piger, "A Comparison of the Real-Time Performance of Business Cycle Dating Methods," Journal of Business and Economic Statistics, 2008, 26, 42-49.

For additional details as to why this data revises, see FAQ 3.

Suggested Citation:

Chauvet, Marcelle and Piger, Jeremy Max, Smoothed U.S. Recession Probabilities [RECPROUSM156N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RECPROUSM156N, .

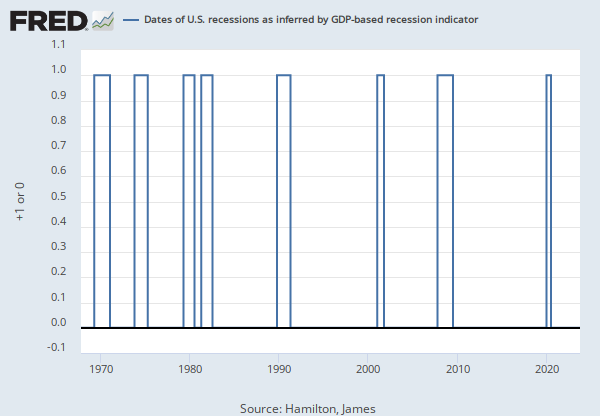

Source: Hamilton, James

Release: GDP-Based Recession Indicator Index

Units: Percentage Points, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

This index measures the probability that the U.S. economy was in a recession during the indicated quarter. It is based on a mathematical description of the way that recessions differ from expansions. The index corresponds to the probability (measured in percent) that the underlying true economic regime is one of recession based on the available data. Whereas the NBER business cycle dates are based on a subjective assessment of a variety of indicators that may not be released until several years after the event, this index is entirely mechanical, is based solely on currently available GDP data and is reported every quarter. Due to the possibility of data revisions and the challenges in accurately identifying the business cycle phase, the index is calculated for the quarter just preceding the most recently available GDP numbers. Once the index is calculated for that quarter, it is never subsequently revised. The value at every date was inferred using only data that were available one quarter after that date and as those data were reported at the time.

If the value of the index rises above 67% that is a historically reliable indicator that the economy has entered a recession. Once this threshold has been passed, if it falls below 33% that is a reliable indicator that the recession is over.

For more information about this series visit http://econbrowser.com/recession-index.

Suggested Citation:

Hamilton, James, GDP-Based Recession Indicator Index [JHGDPBRINDX], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/JHGDPBRINDX, .

Source: Federal Reserve Bank of St. Louis

Release: Recession Indicators Series

Units: +1 or 0, Not Seasonally Adjusted

Frequency: Monthly

Notes:

This time series is an interpretation of US Business Cycle Expansions and Contractions data provided by The National Bureau of Economic Research (NBER) at http://www.nber.org/cycles/cyclesmain.html. Our time series is composed of dummy variables that represent periods of expansion and recession. The NBER identifies months and quarters of turning points without designating a date within the period that turning points occurred. The dummy variable adopts an arbitrary convention that the turning point occurred at a specific date within the period. The arbitrary convention does not reflect any judgment on this issue by the NBER's Business Cycle Dating Committee. A value of 1 is a recessionary period, while a value of 0 is an expansionary period. For this time series, the recession begins midpoint of the period of the peak and ends midpoint of the period of the trough. Therefore, the recession period includes the entire period of both peak and trough. For more options on recession shading, see the notes and links below.

The recession shading data that we provide initially comes from the source as a list of dates that are either an economic peak or trough. We interpret dates into recession shading data using one of three arbitrary methods. All of our recession shading data is available using all three interpretations. The period between a peak and trough is always shaded as a recession. The peak and trough are collectively extrema. Depending on the application, the extrema, both individually and collectively, may be included in the recession period in whole or in part. In situations where a portion of a period is included in the recession, the whole period is deemed to be included in the recession period.

The first interpretation, known as the midpoint method, is to show a recession from the midpoint of the peak through the midpoint of the trough for monthly and quarterly data. For daily data, the recession begins on the 15th of the month of the peak and ends on the 15th of the month of the trough. Daily data is a disaggregation of monthly data. For monthly and quarterly data, the entire peak and trough periods are included in the recession shading. This method shows the maximum number of periods as a recession for monthly and quarterly data. The Federal Reserve Bank of St. Louis uses this method in its own publications. The midpoint method is used for this series.

The second interpretation, known as the trough method, is to show a recession from the period following the peak through the trough (i.e. the peak is not included in the recession shading, but the trough is). For daily data, the recession begins on the first day of the first month following the peak and ends on the last day of the month of the trough. Daily data is a disaggregation of monthly data. The trough method is used when displaying data on FRED graphs. A version of this time series represented using the trough method can be found at:

https://fred.stlouisfed.org/series/USREC

The third interpretation, known as the peak method, is to show a recession from the period of the peak to the trough (i.e. the peak is included in the recession shading, but the trough is not). For daily data, the recession begins on the first day of the month of the peak and ends on the last day of the month preceding the trough. Daily data is a disaggregation of monthly data. A version of this time series represented using the peak method can be found at:

https://fred.stlouisfed.org/series/USRECP

Suggested Citation:

Federal Reserve Bank of St. Louis, NBER based Recession Indicators for the United States from the Peak through the Trough [USRECM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USRECM, .

Source: Federal Reserve Bank of Chicago

Release: Chicago Fed National Activity Index

Units: Index, Not Seasonally Adjusted

Frequency: Monthly

Notes:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

For further information, please visit the Federal Reserve Bank of Chicago's web site:

http://www.chicagofed.org/webpages/research/data/cfnai/current_data.cfm

Suggested Citation:

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CFNAIMA3, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Federal Reserve Board of Governors Labor Market Conditions Index

Units: Index Points, Seasonally Adjusted

Frequency: Monthly

Notes:

As of August 3, 2017, updates of the labor market conditions index (LMCI) have been discontinued; the July 7, 2017 vintage is the final estimate from this model. The Board decided to stop updating the LMCI because they believe it no longer provides a good summary of changes in U.S. labor market conditions. Specifically, model estimates turned out to be more sensitive to the detrending procedure than expected, the measurement of some indicators in recent years has changed in ways that significantly degraded their signal content, and including average hourly earnings as an indicator did not provide a meaningful link between labor market conditions and wage growth.

The LMCI is derived from a dynamic factor model that extracts the primary common variation from 19, seasonally-adjusted, labor market indicators. Users can read about the included indicators at http://www.federalreserve.gov/econresdata/notes/feds-notes/2014/updating-the-labor-market-conditions-index-20141001.html.

Users of the LMCI should take note that the entire history of the LMCI may revise each month. Three sources contribute to such revisions. The first source is new data that were not available at the time of the employment report. In particular, at the time of the Employment Situation report each month, the quit rate and hiring rate will be missing for the last two months of the sample because the Job Openings and Labor Turnover Survey is published with a longer lag than the model's other indicators. In subsequent months, as these data become available, the LMCI will revise.

The second source of revision comes from revisions to existing data. Many labor market indicators are subject to revision as additional source data become available or to incorporate annual benchmark revisions or updated seasonal adjustment factors. Prominent examples in the LMCI include the three payroll employment series from the Current Employment Statistics program.

The third source of revision is inherent to the model. The LMCI is derived from the Kalman smoother, meaning that the estimate of the index in any particular month is the model's best assessment given all past and future observations. Thus, when a new month of data is added to the sample, the model will revise its estimate of history in response to the new information. In practice, these revisions tend to be modest and concentrated in the most-recent six months of the sample.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Change in Labor Market Conditions Index (DISCONTINUED) [FRBLMCI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FRBLMCI, .

Source: Federal Reserve Bank of St. Louis

Release: Recession Indicators Series

Units: +1 or 0, Not Seasonally Adjusted

Frequency: Monthly

Notes:

This time series is an interpretation of Organisation of Economic Development (OECD) Composite Leading Indicators: Reference Turning Points and Component Series data, which can be found at http://www.oecd.org/std/leading-indicators/oecdcompositeleadingindicatorsreferenceturningpointsandcomponentseries.htm. The OECD identifies months of turning points without designating a date within the month that turning points occurred. The dummy variable adopts an arbitrary convention that the turning point occurred at a specific date within the month. The arbitrary convention does not reflect any judgment on this issue by the OECD. Our time series is composed of dummy variables that represent periods of expansion and recession. A value of 1 is a recessionary period, while a value of 0 is an expansionary period. For this time series, the recession begins midpoint of the period of the peak and ends midpoint of the period of the trough. Therefore, the recession period includes the entire period of both peak and trough. For more options on recession shading, see the notes and links below.

The recession shading data that we provide initially comes from the source as a list of dates that are either an economic peak or trough. We interpret dates into recession shading data using one of three arbitrary methods. All of our recession shading data is available using all three interpretations. The period between a peak and trough is always shaded as a recession. The peak and trough are collectively extrema. Depending on the application, the extrema, both individually and collectively, may be included in the recession period in whole or in part. In situations where a portion of a period is included in the recession, the whole period is deemed to be included in the recession period.

The first interpretation, known as the midpoint method, is to show a recession from the midpoint of the peak through the midpoint of the trough for monthly and quarterly data. For daily data, the recession begins on the 15th of the month of the peak and ends on the 15th of the month of the trough. Daily data is a disaggregation of monthly data. For monthly and quarterly data, the entire peak and trough periods are included in the recession shading. This method shows the maximum number of periods as a recession for monthly and quarterly data. The Federal Reserve Bank of St. Louis uses this method in its own publications. The midpoint method is used for this series.

The second interpretation, known as the trough method, is to show a recession from the period following the peak through the trough (i.e. the peak is not included in the recession shading, but the trough is). For daily data, the recession begins on the first day of the first month following the peak and ends on the last day of the month of the trough. Daily data is a disaggregation of monthly data. The trough method is used when displaying data on FRED graphs. A version of this time series represented using the trough method can be found at:

https://fred.stlouisfed.org/series/USAREC

The third interpretation, known as the peak method, is to show a recession from the period of the peak to the trough (i.e. the peak is included in the recession shading, but the trough is not). For daily data, the recession begins on the first day of the month of the peak and ends on the last day of the month preceding the trough. Daily data is a disaggregation of monthly data. A version of this time series represented using the peak method can be found at:

https://fred.stlouisfed.org/series/USARECP

The OECD CLI system is based on the "growth cycle" approach, where business cycles and turning points are measured and identified in the deviation-from-trend series. The main reference series used in the OECD CLI system for the majority of countries is industrial production (IIP) covering all industry sectors excluding construction. This series is used because of its cyclical sensitivity and monthly availability, while the broad based Gross Domestic Product (GDP) is used to supplement the IIP series for identification of the final reference turning points in the growth cycle.

Zones aggregates of the CLIs and the reference series are calculated as weighted averages of the corresponding zone member series (i.e. CLIs and IIPs).

Up to December 2008 the turning points chronologies shown for regional/zone area aggregates or individual countries are determined by the rules established by the National Bureau of Economic Research (NBER) in the United States, which have been formalized and incorporated in a computer routine (Bry and Boschan) and included in the Phase-Average Trend (PAT) de-trending procedure. Starting from December 2008 the turning point detection algorithm is decoupled from the de-trending procedure, and is a simplified version of the original Bry and Boschan routine. (The routine parses local minima and maxima in the cycle series and applies censor rules to guarantee alternating peaks and troughs, as well as phase and cycle length constraints.)

The components of the CLI are time series which exhibit leading relationship with the reference series (IIP) at turning points. Country CLIs are compiled by combining de-trended smoothed and normalized components. The component series for each country are selected based on various criteria such as economic significance; cyclical behavior; data quality; timeliness and availability.

OECD data should be cited as follows: OECD Composite Leading Indicators, "Composite Leading Indicators: Reference Turning Points and Component Series", http://www.oecd.org/std/leading-indicators/oecdcompositeleadingindicatorsreferenceturningpointsandcomponentseries.htm (Accessed on date)

Suggested Citation:

Federal Reserve Bank of St. Louis, OECD based Recession Indicators for the United States from the Peak through the Trough (DISCONTINUED) [USARECM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USARECM, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

NBER based Recession Indicators for the United States from the Peak through the Trough

Daily, Not Seasonally Adjusted Quarterly, Not Seasonally AdjustedOECD based Recession Indicators for the United States from the Peak through the Trough (DISCONTINUED)

Daily, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.