Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Federal Reserve Bank of Philadelphia

Release: State Leading Indexes

Units: Percent, Seasonally Adjusted

Frequency: Monthly

Notes:

The leading index for each state predicts the six-month growth rate of the state's coincident index. In addition to the coincident index, the models include other variables that lead the economy: state-level housing permits (1 to 4 units), state initial unemployment insurance claims, delivery times from the Institute for Supply Management (ISM) manufacturing survey, and the interest rate spread between the 10-year Treasury bond and the 3-month Treasury bill.

Suggested Citation:

Federal Reserve Bank of Philadelphia, Leading Index for the United States [USSLIND], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USSLIND, .

Source: Nasdaq, Inc.

Release: Nasdaq Daily Index Data

Units: Index Feb 5, 1971=100, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

The observations for the NASDAQ Composite Index represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when it sometimes closes early.

The NASDAQ Composite Index is a market capitalization weighted index with more than 3000 common equities listed on the NASDAQ Stock Market. The types of securities in the index include American depositary receipts (ADRs), common stocks, real estate investment trusts (REITs), and tracking stocks. The index includes all NASDAQ listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

Copyright © 2016, NASDAQ OMX Group, Inc.

Suggested Citation:

Nasdaq, Inc., NASDAQ Composite Index [NASDAQCOM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NASDAQCOM, .

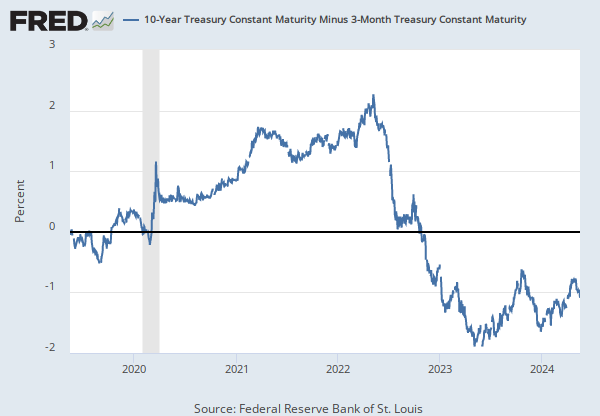

Source: Federal Reserve Bank of St. Louis

Release: Interest Rate Spreads

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department.

Series is calculated as the spread between 10-Year Treasury Constant Maturity (BC_10YEAR) and 2-Year Treasury Constant Maturity (BC_2YEAR). Both underlying series are published at the U.S. Treasury Department.

Suggested Citation:

Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/T10Y2Y, .

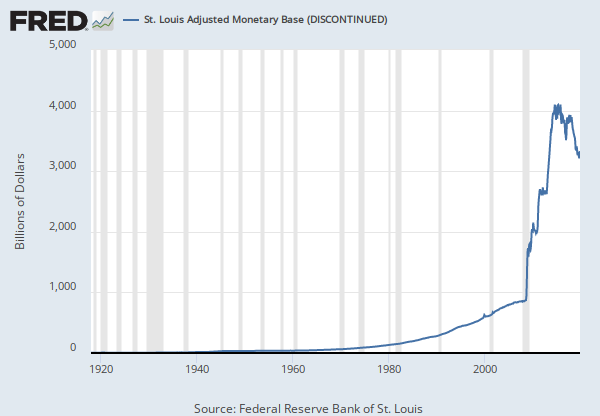

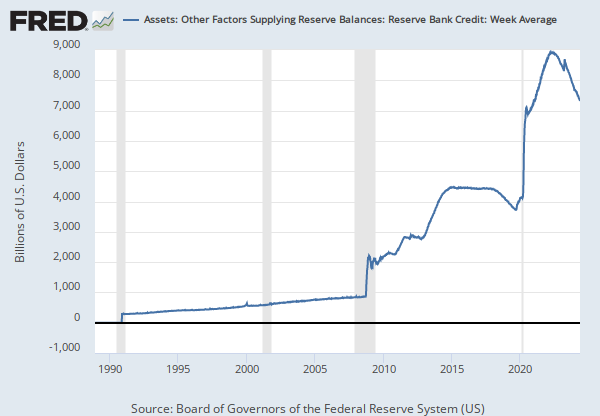

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances (data not included in press release)

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

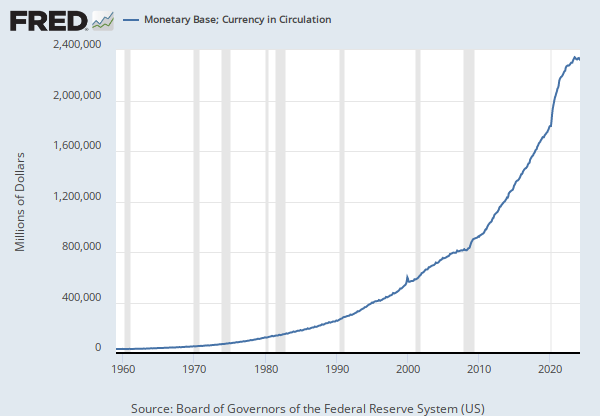

This series has been discontinued and will no longer be updated. The weekly version of this monthly series is WCURCIR.####

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Currency in Circulation (DISCONTINUED) [CURRCIR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CURRCIR, .

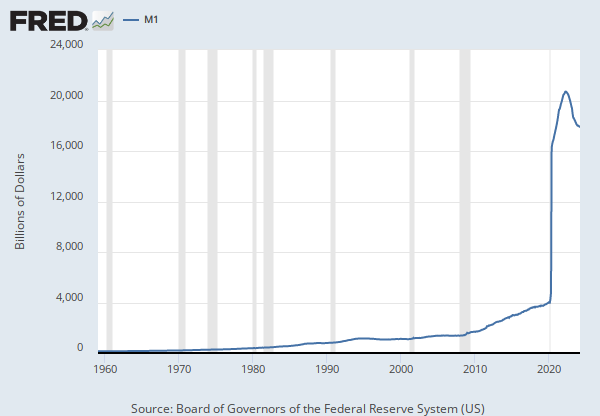

Source: Board of Governors of the Federal Reserve System (US)

Release: Senior Loan Officer Opinion Survey on Bank Lending Practices

Units: Percent, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

This data series is part of the Board of Governors of the Federal Reserve System's Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS). The purpose of the survey is to provide qualitative and limited quantitative information on bank credit availability and loan demand, as well as on evolving developments and lending practices in the U.S. loan markets. A portion of each survey typically covers special topics of timely interest.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms [DRTSCILM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DRTSCILM, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Other Factors Draining Reserve Balances: Currency in Circulation: Week Average [WCURCIR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WCURCIR, .

Source: U.S. Bureau of Labor Statistics

Release: Employment Situation

Units: Hours, Seasonally Adjusted

Frequency: Monthly

Notes:

Average weekly hours relate to the average hours per worker for which pay was received and is different from standard or scheduled hours. Factors such as unpaid absenteeism, labor turnover, part-time work, and stoppages cause average weekly hours to be lower than scheduled hours of work for an establishment. Group averages further reflect changes in the workweek of component industries. Average weekly hours are the total weekly hours divided by the employees paid for those hours.

Production and related employees include working supervisors and all nonsupervisory employees (including group leaders and trainees) engaged in fabricating, processing, assembling, inspecting, receiving, storing, handling, packing, warehousing, shipping, trucking, hauling, maintenance, repair, janitorial, guard services, product development, auxiliary production for plant's own use (for example, power plant), recordkeeping, and other services closely associated with the above production operations.

Nonsupervisory employees include those individuals in private, service-providing industries who are not above the working-supervisor level. This group includes individuals such as office and clerical workers, repairers, salespersons, operators, drivers, physicians, lawyers, accountants, nurses, social workers, research aides, teachers, drafters, photographers, beauticians, musicians, restaurant workers, custodial workers, attendants, line installers and repairers, laborers, janitors, guards, and other employees at similar occupational levels whose services are closely associated with those of the employees listed.

The series comes from the 'Current Employment Statistics (Establishment Survey).'

The source code is: CES3000000007

Suggested Citation:

U.S. Bureau of Labor Statistics, Average Weekly Hours of Production and Nonsupervisory Employees, Manufacturing [AWHMAN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AWHMAN, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Senior Loan Officer Opinion Survey on Bank Lending Practices

Units: Percent, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

This data series is part of the Board of Governors of the Federal Reserve System's Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS). The purpose of the survey is to provide qualitative and limited quantitative information on bank credit availability and loan demand, as well as on evolving developments and lending practices in the U.S. loan markets. A portion of each survey typically covers special topics of timely interest.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Net Percentage of Domestic Banks Reporting Stronger Demand for Qualified Mortgage Jumbo Mortgage Loans [SUBLPDHMDJNQ], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SUBLPDHMDJNQ, .

Source: Organization for Economic Co-operation and Development

Release: Main Economic Indicators

Units: Index, Seasonally Adjusted

Frequency: Monthly

Notes:

OECD Data Filters:

REF_AREA: USA

MEASURE: LI

UNIT_MEASURE: IX

ACTIVITY: _Z

ADJUSTMENT: NOR

TRANSFORMATION: IX

TIME_HORIZ: _Z

METHODOLOGY: H

FREQ: M

All OECD data should be cited as follows: OECD (year), (dataset name), (data source) DOI or https://data-explorer.oecd.org/. (accessed on (date)).

Suggested Citation:

Organization for Economic Co-operation and Development, Composite Leading Indicators: Composite Leading Indicator (CLI) Normalized for United States [USALOLITONOSTSAM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USALOLITONOSTSAM, .

Source: Federal Reserve Bank of Chicago

Release: Chicago Fed National Financial Conditions Index

Units: Index, Not Seasonally Adjusted

Frequency: Weekly, Ending Friday

Notes:

The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and “shadow” banking systems. Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.

The adjusted NFCI (ANFCI). This index isolates a component of financial conditions uncorrelated with economic conditions to provide an update on how financial conditions compare with current economic conditions.

For further information, please visit the Federal Reserve Bank of Chicago's web site: http://www.chicagofed.org/webpages/publications/nfci/index.cfm

Suggested Citation:

Federal Reserve Bank of Chicago, Chicago Fed Adjusted National Financial Conditions Index [ANFCI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ANFCI, .

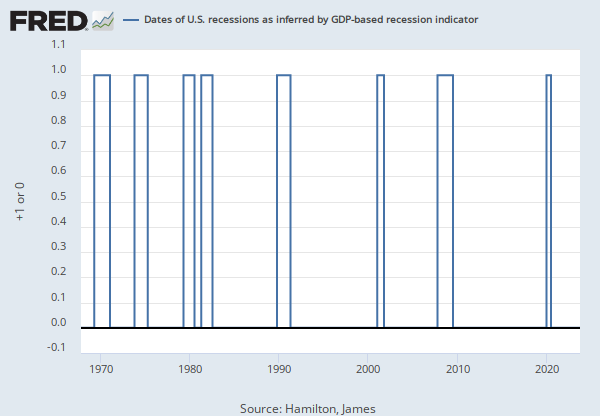

Source: Chauvet, Marcelle

Source: Piger, Jeremy Max

Release: U.S. Recession Probabilities

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., "An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching," International Economic Review, 1998, 39, 969-996.

For additional details, including an analysis of the performance of this model for dating business cycles in real time, see:

Chauvet, M. and J. Piger, "A Comparison of the Real-Time Performance of Business Cycle Dating Methods," Journal of Business and Economic Statistics, 2008, 26, 42-49.

For additional details as to why this data revises, see FAQ 3.

Suggested Citation:

Chauvet, Marcelle and Piger, Jeremy Max, Smoothed U.S. Recession Probabilities [RECPROUSM156N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RECPROUSM156N, .

Source: Chicago Board Options Exchange

Release: CBOE Market Statistics

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

VIX measures market expectation of near term volatility conveyed by stock index option prices. Copyright, 2016, Chicago Board Options Exchange, Inc. Reprinted with permission.

Suggested Citation:

Chicago Board Options Exchange, CBOE Volatility Index: VIX [VIXCLS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/VIXCLS, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Monthly, Not Seasonally AdjustedAverage Weekly Hours of Production and Nonsupervisory Employees, Manufacturing

Monthly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.